Federal Reserve’s Impact

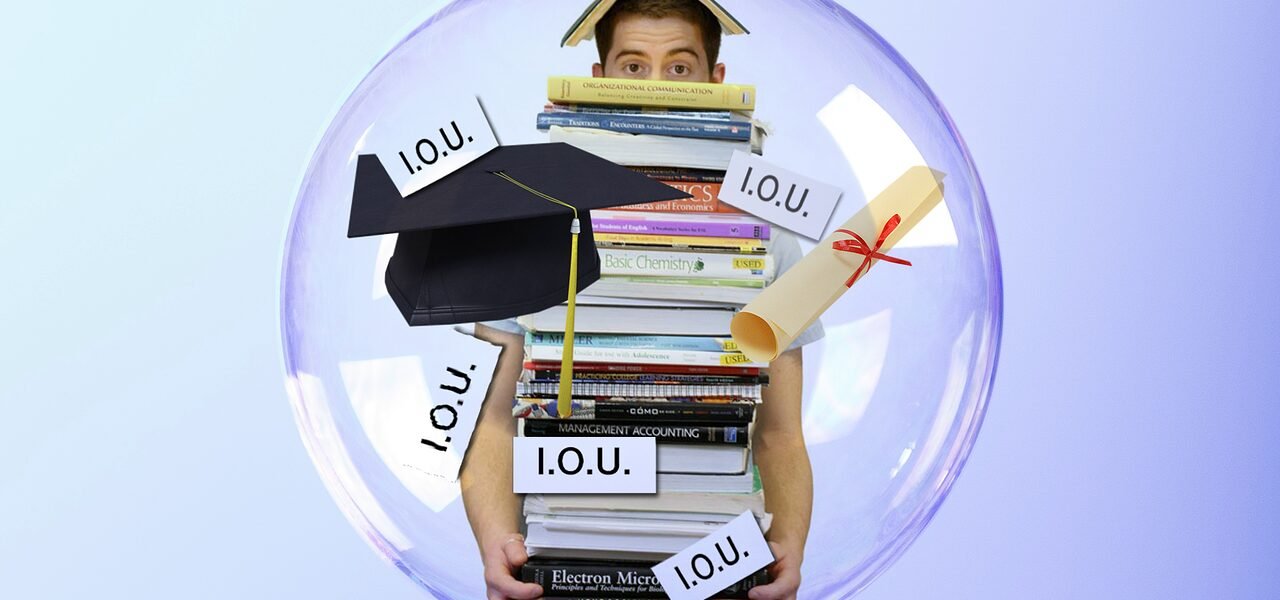

The Federal Reserve’s aggressive interest rate hikes have reshaped the financial landscape, leading to an unexpected development: auto loan debt has surpassed student loan debt for the first time, as reported by Automoblog. The end of Q2 2023 marked this pivotal shift, with auto loan debt reaching $1.58 trillion, slightly edging out student loan debt at $1.57 trillion.

The Role of Interest Rates

Rising interest rates, a consequence of the Federal Reserve’s 11 rate hikes since March of the previous year, have significantly impacted auto loan dynamics. The federal funds rate now stands at a 22-year high of 5.25% to 5.5%, aiming to curb inflation. This has led to a surge in annual percentage rates (APRs) for financing new cars, reaching 7.4%, while used vehicle rates climbed to 11.2%, according to a recent Edmunds survey.

Factors Contributing to Auto Loan Debt

The spike in APRs since 2022 is a primary driver behind the surge in car payments surpassing student loan payments. However, according to Experian’s Melinda Zabritski, another critical factor is the increase in vehicle prices. Inventory shortages and an uptick in vehicle pricing have forced consumers to take out larger loans. The popularity of SUVs, constituting over 60% of new vehicles financed in Q2 2023, has contributed to the trend of financing more expensive vehicles.

Consequences: Missed Payments and Tightening Restrictions

As auto debt escalates, missed payments have also surged. The Federal Reserve reports a 13.3% increase in auto loans delinquent for 60 days or more in September, marking the fifth consecutive month of growth. Subprime borrowers face the highest delinquency rate in nearly 30 years, reaching 6.1% in September.

In response to the evolving automotive landscape, lenders are tightening restrictions on auto financing. Approximately 30% of lenders, according to a recent Fed survey, noted significantly more stringent lending standards. Some lenders, such as Citizens Financial Group, have exited the market, while others, including Capital One, have scaled back their auto loans business.

Strategies for Consumers

Amidst the high-interest environment, consumers can take strategic steps to lower financing costs:

1. Credit Scores and Down Payments

In a tighter lending environment, credit scores play a crucial role. While there’s no universal minimum credit score for a car loan, higher scores enhance approval chances and improve loan terms. Making a down payment can also contribute to lower rates, reducing the overall amount borrowed and, consequently, interest paid.

2. Pre-Approved Financing and Used Vehicles

Exploring pre-approved financing options diligently can help secure better deals, as consumers should approach financing with the same diligence as selecting a vehicle. Additionally, opting for a used vehicle can provide better bargains, capitalizing on the significant depreciation that occurs in the first year of a new car.

3. Exploring Auto Insurance for Savings

As consumers grapple with rising car prices, exploring new auto insurance providers can offer potential savings. Platforms like Credible provide a marketplace for comparing multiple insurance providers, allowing individuals to choose the one offering the best rates.

Expert Guidance through Credible

For those navigating the complexities of financial decisions, Credible stands as a trusted guide. The platform not only facilitates comparison shopping for loans and insurance but also serves as a source of expert advice. Consumers can direct their finance-related questions to The Credible Money Expert at moneyexpert@credible.com, potentially having them addressed in the Money Expert column.

In a financial landscape shaped by interest rate fluctuations and evolving market dynamics, informed decision-making becomes paramount. Platforms like Credible empower consumers to navigate these challenges with clarity and confidence.

Download our app MadbuMax on the Apple App Store for the latest news and financial tools. Interested in getting your finances in order do not forget to check Dr. Paul Etienne’s best-seller book on personal finance. To access more resources, tools, and services please click here. Also, do not forget to follow Dr. Etienne on IG or Twitter.