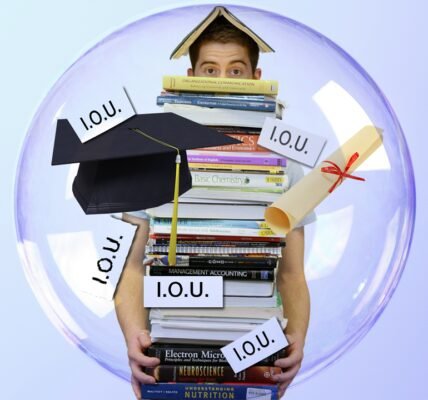

Planning for college can be an exciting yet daunting experience. As you embark on this journey, it’s important to have a clear understanding of the financial aspects, particularly student loans. In this article, we will explore the ins and outs of student loans, providing you with comprehensive information to make informed decisions. So let’s dive right in!

What Are Student Loans?

Student loans are financial aids specifically designed to help students cover the costs of their education. These loans are offered by government institutions, private lenders, and financial organizations. They provide students with funds to pay for tuition fees, textbooks, accommodation, and other educational expenses.

Types of Student Loans

1. Federal Student Loans

Federal student loans are loans funded by the government and are typically more flexible and affordable than private loans. These loans come with fixed interest rates and offer various repayment plans to suit individual financial situations. Examples of federal student loans include Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans.

2. Private Student Loans

Private student loans are provided by banks, credit unions, and other financial institutions. Unlike federal loans, private loans are not backed by the government and may have higher interest rates. The terms and conditions of private loans vary among lenders, and eligibility often depends on credit history and income.

Understanding Interest Rates

Interest rates play a crucial role in student loans as they determine the cost of borrowing money. Federal student loans generally have lower interest rates compared to private loans. It’s essential to consider the long-term financial implications of interest rates when choosing a loan.

Repayment Options

Repaying student loans is a significant responsibility, and understanding the available repayment options is vital. Here are a few common repayment plans:

1. Standard Repayment Plan

This is the most straightforward option, where borrowers make fixed monthly payments over a set period of time. The loan is typically paid off in ten years, but this can vary depending on the loan amount.

2. Income-Driven Repayment Plans

Income-Driven Repayment Plans are designed to adjust monthly payments based on the borrower’s income and family size. These plans can provide more manageable payment options, especially for those with lower incomes.

3. Loan Forgiveness Programs

Certain careers, such as public service or teaching, may qualify for loan forgiveness programs. These programs forgive a portion or the entire outstanding loan balance after meeting specific criteria.

Conclusion

Planning for college involves careful consideration of the financial aspects, and student loans are an integral part of that process. By understanding the different types of student loans, interest rates, and repayment options, you can make informed decisions about financing your education. Remember to research and compare various loan options, seeking advice from financial experts when necessary. Good luck with your college journey!

Download our app MadbuMax on the Apple App Store for the latest news and financial tools. Interested in getting your finances in order do not forget to check Dr. Paul Etienne’s best-seller book on personal finance. To access more resources, tools and services please click here. Also do not forget to follow Dr. Etienne on IG or Twitter.