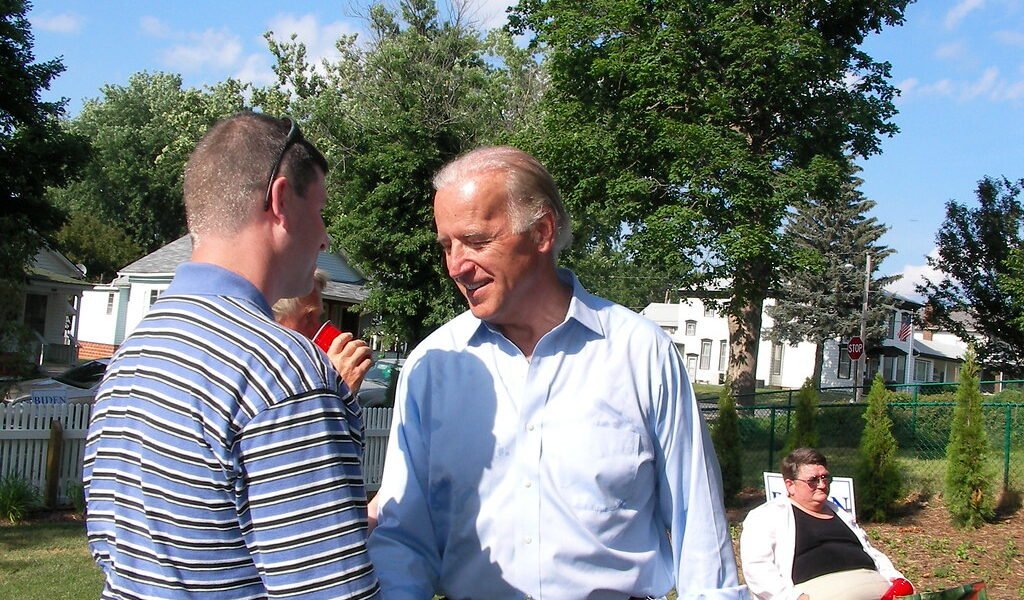

In a significant move by President Joe Biden’s administration, borrowers struggling with their student loan debts can breathe a sigh of relief until September 30, 2024. Following the Supreme Court’s rejection of a forgiveness plan earlier this year, a temporary on-ramp period has been introduced. This initiative ensures that those unable to meet their loan obligations will be automatically enrolled into a 12-month grace period, shielding them from the harsh consequences of missed or late payments.

Harvard’s Insightful Guidance

Harvard University Employee Credit Union, in a recent blog post, highlighted the essence of this on-ramp period. Borrowers, although exempt from delinquency reports to credit agencies, should note that interest continues to accrue during this grace period. The blog emphasized that missed payments won’t count towards future loan forgiveness, potentially leaving borrowers grappling with increased debt due to accrued interest rates.

Delinquency to Default: A Dire Descent

The Department of Education underscores the gravity of student loan delinquency. A single missed payment renders the loan delinquent, leading to subsequent adverse actions if the overdue amount isn’t settled or suitable arrangements aren’t made. Default status looms after 270 days of missed payments, varying based on the loan type. Defaulting could prompt immediate repayment demands, creating an even heavier burden for borrowers.

Fresh Start Initiative: A Second Chance

Amidst these challenges, the Department of Education’s “Fresh Start” initiative offers defaulted borrowers a lifeline. Those in default before the pandemic payment pause were automatically brought current under this program. It not only aids in rebuilding credit but also reinstates eligibility for crucial federal benefits, providing a chance to regain financial stability.

Tax Troubles Looming Over Borrowers

While President Biden’s income-driven repayment plans promise relief, a new concern emerges – taxation on forgiven student debts. The American Rescue Plan Act of 2021 exempts discharged student debt from federal tax, but several states still impose taxes on these savings. As of 2023, states like Indiana, North Carolina, and Mississippi are taxing forgiven student loan balances, potentially burdening borrowers with unexpected tax bills.

Planning Ahead for a Secure Future

With federal tax exemptions expiring on January 1, 2026, borrowers are urged to prepare for potential tax liabilities. Michael Lux, founder of Student Loan Sherpa, advises borrowers to anticipate sizable tax bills and plan accordingly. Planning ahead becomes crucial, especially for those banking on forgiveness post-2026, ensuring they aren’t blindsided by tax-related challenges.

Exploring Financial Avenues

For students seeking additional financial aid beyond federal assistance, private student loans offer an alternative. Credible, a trusted platform, provides personalized rates without affecting credit scores. This option allows students to bridge the financial gap and pursue their education without compromising their financial stability.

H2: Navigating the Student Loan Maze

In the maze of student loans, President Biden’s on-ramp initiative provides a glimmer of hope for struggling borrowers. However, it’s crucial to navigate this complex terrain with caution. Understanding the nuances of repayment plans, defaults, and potential tax implications empowers borrowers to make informed decisions, ensuring a secure financial future amidst these challenges.

Download our app MadbuMax on the Apple App Store for the latest news and financial tools. Interested in getting your finances in order do not forget to check Dr. Paul Etienne’s best-seller book on personal finance. To access more resources, tools, and services please click here. Also, do not forget to follow Dr. Etienne on IG or Twitter.