In a concerning economic shift, Americans have felt the pinch as their incomes dipped in the wake of skyrocketing inflation. New data from the U.S. Census Bureau reveals that real median household income, which stood at $76,330 in 2021, took a significant hit, dropping to $74,580 in 2022—a substantial 2.3% decline. This marks the third consecutive year of falling incomes since the onset of the COVID-19 pandemic in 2020.

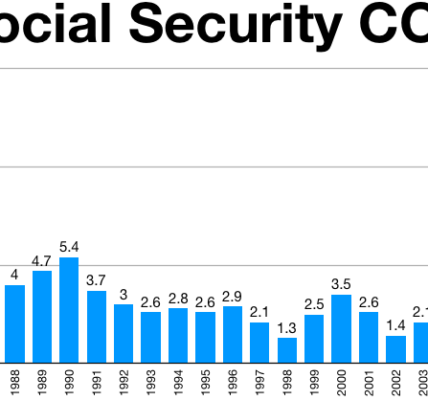

While the nation grapples with these income losses, inflation continues its relentless climb. The year 2022 saw inflation surge by a staggering 7.8%, the most significant annual increase in the cost of living adjustment (COLA) since 1981, according to the Census Bureau.

The impact of these economic challenges varies across age groups. Those aged 45 to 54 bore the brunt of the income reductions, experiencing a 3.0% annual drop in 2022. Meanwhile, individuals aged 65 and older saw a 2.1% decline in their incomes.

To make ends meet, a growing number of Americans have turned to government assistance programs. The Supplemental Poverty Measure (SPM) rate, which factors in government benefits, rose to 12.4% in 2022—a 4.6 percentage point increase from 2021. This marked the first uptick in the SPM since 2010.

The Census Bureau attributes this trend to changes in federal tax policy, including the expiration of temporary expansions to the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC), as well as the discontinuation of pandemic-era stimulus payments.

Rising Credit Card Debt in Response

As income dwindled and inflation surged, Americans found themselves shouldering record-high credit card debt. In a startling revelation, credit card debt swelled to a staggering $1.03 trillion in the second quarter of 2023, according to the latest report from the Federal Reserve Bank of New York—an increase of $45 billion from the previous quarter.

Many Americans now rely on credit cards more than ever before. A survey by Quicken showed that 35% of respondents are likely to max out at least one of their credit cards before the end of 2023. Additionally, 38% admitted they would need to use credit cards for expenses they previously didn’t rely on them for.

However, the burden of credit card debt disproportionately affects younger generations. A staggering 53% of millennials and 41% of Gen Z individuals reported an increased reliance on credit cards, according to the survey.

The Struggle Amidst Inflation

The situation could worsen as the Federal Reserve aggressively raises interest rates to combat inflation, which surged by 3.7% month-over-month in August—far beyond the Fed’s 2% target range. Currently, the average interest rate on credit cards stands at a daunting 20.68%, as per data from the Federal Reserve Bank of St. Louis.

Conversely, personal loans offer a glimmer of hope. With an average interest rate of 11.48%, they present a viable option for those looking to escape the clutches of high-interest credit card debt. The appeal of personal loans for credit card consolidation saw a remarkable 54% increase in the third quarter of 2022 compared to the same period in 2019, as reported by TransUnion.

Liz Pagel, the Senior Vice President and Head of TransUnion’s consumer lending business, noted, “As the Fed has raised interest rates in hopes of curbing inflation, many consumers have turned to unsecured personal loans as a way to consolidate their credit card debt to get a lower interest rate.” Pagel added that this approach not only saves on interest over time but also leads to improvements in credit scores.

A Path to Financial Freedom

While Americans have collectively amassed staggering levels of debt, individuals can take steps to expedite the debt repayment process. One such avenue is through personal loans, which provide a lump sum ranging from a few hundred dollars to several hundred thousand. These loans typically offer lower interest rates, potentially reducing monthly payments. Moreover, personal loans often come with fixed interest rates, ensuring consistency in monthly repayments, with typical loan terms ranging from one to five years.

Consumers should be vigilant, however, as some lenders may charge origination fees or impose prepayment penalties. Fortunately, many lenders have eliminated these fees to make personal loans more accessible.

It’s crucial to maintain consistent payments and avoid accumulating additional debt. Margaret Poe, TransUnion’s Head of Consumer Credit Education, emphasized, “Consolidating credit card debt into an unsecured personal loan can be a good option to pay your debt off while freeing up funds in your monthly budget.” She also stressed the importance of changing spending habits to prevent a recurrence of credit card debt.

For those ready to tackle their high-interest debt with a personal loan, the Credible marketplace offers a convenient platform to compare options from different lenders without impacting your credit score.

In the midst of economic challenges, exploring these financial strategies may offer relief to those grappling with income declines and mounting credit card debt.

Download our app MadbuMax on the Apple App Store for the latest news and financial tools. Interested in getting your finances in order do not forget to check Dr. Paul Etienne’s best-seller book on personal finance. To access more resources, tools, and services please click here. Also, do not forget to follow Dr. Etienne on IG or Twitter.