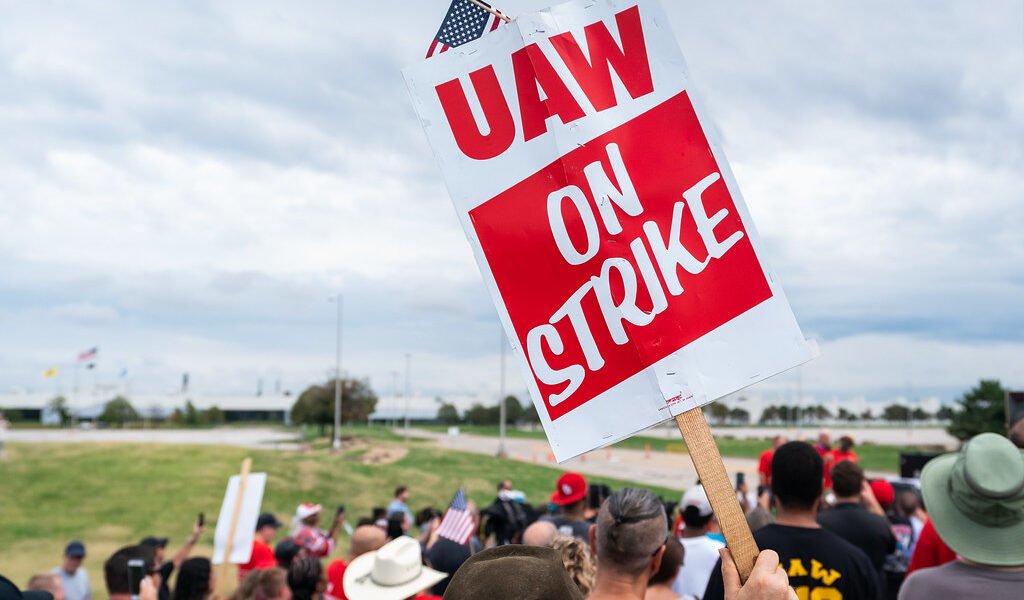

Investors brace themselves for a week filled with significant events, as the United Auto Workers (UAW) strike against Detroit’s automotive giants persists. Simultaneously, a flurry of corporate earnings reports and FOX Business’ Republican presidential primary debate add to the economic and political dynamism.

UAW Strike’s Tenacious Standoff

The UAW strike, which has General Motors (GM), Stellantis, and Ford in its grip, has now entered its 10th consecutive day. While UAW President Shawn Fain hinted at progress with Ford, GM and Stellantis remain locked in a standoff. This labor dispute has not only caught the attention of investors but is also drawing political interest.

Presidential Visit Imminent

On the political front, President Biden is expected to make an appearance at the picket line in Michigan on Tuesday. His visit is a testament to the significance of this strike, which has far-reaching implications for both the automotive industry and the broader economy.

Nasdaq Welcomes Blue Apron

In a noteworthy corporate move, Blue Apron is set to bid adieu to the New York Stock Exchange and commence trading on the Nasdaq Global Market under the familiar ticker symbol “APRN.” This transition adds a new chapter to the company’s journey in the stock market.

Antitrust Decision Looms for Microsoft

Across the Atlantic, in the United Kingdom, antitrust regulators are poised to make a preliminary decision regarding Microsoft’s acquisition of Activision. Encouragingly, regulators have expressed satisfaction with the steps taken by both companies to address anticompetitive concerns. If granted full approval, this deal would bestow upon Microsoft a treasure trove of lucrative video game titles, including the iconic “Call of Duty.”

Costco’s Earnings Report

Costco, the warehouse retail giant, is gearing up to report its earnings on Tuesday. Beyond financials, investors eagerly anticipate insights into the state of inflation, particularly in the realm of food prices. This report could offer valuable insights into the ongoing economic challenges.

Housing Market Blues

Meanwhile, data unveiled by the National Association of Realtors on Thursday revealed a continued decline in U.S. existing home sales during August. This downward trajectory is attributed to the dual pressures of persistently high mortgage rates, hovering above 7%, and a worsening shortage of available housing options. The housing market remains a point of concern for economists and prospective homeowners alike.

Republican Primary Debate

Shifting to the political arena, the second Republican primary debate is scheduled to take place at the Reagan Presidential Library in Simi Valley, California. Hosted by FOX Business, the debate is set to air from 9-11 p.m. ET, promising lively discussions and insights into the contenders’ platforms.

Midweek Earnings and Economic Data

On Wednesday, investors will be keenly watching as Micron Technology and H.B. Fuller release their earnings reports. Concurrently, economic data releases will cover mortgage applications, durable goods, and EIA weekly crude stocks, providing a comprehensive snapshot of economic health.

Nike, CarMax, and BlackBerry on Earnings Radar

Towards the end of the week, attention turns to earnings reports from Nike, CarMax, and BlackBerry. Nike, in particular, has been under the spotlight, having seen its stock price drop for ten consecutive days, resulting in a cumulative loss of over 11% this year. Investors will closely scrutinize these reports for signs of recovery or further turbulence.

Impeachment Inquiry Hearings Commence

As the week unfolds, House Republicans, led by House Speaker Kevin McCarthy, will initiate the first hearing regarding President Joe Biden’s impeachment inquiry. This political development adds another layer of complexity to an already eventful week.

Carnival of Economic Data

Closing the week, economic reporting on Friday will feature the latest data on personal income and consumption. This data will provide critical insights into the state of consumer finances and spending habits, offering a glimpse into the overall economic landscape.

In a week filled with labor strikes, corporate maneuvers, political debates, and economic data releases, investors and the general public alike remain on high alert, awaiting the outcomes that will shape the trajectory of markets and politics in the days to come.

Download our app MadbuMax on the Apple App Store for the latest news and financial tools. Interested in getting your finances in order do not forget to check Dr. Paul Etienne’s best-seller book on personal finance. To access more resources, tools, and services please click here. Also, do not forget to follow Dr. Etienne on IG or Twitter.