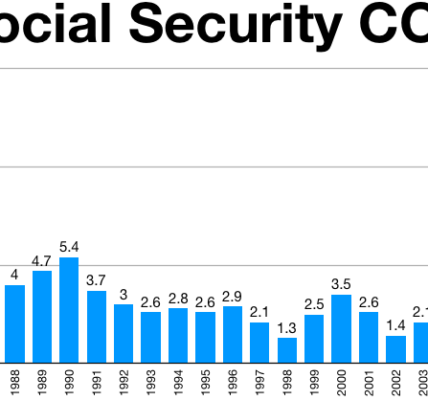

Amidst the intricate tapestry of real estate dynamics, the resolute march of annual home price growth persisted, albeit with a measured increase of 1.4% in May. This surge marks the 12th consecutive month of appreciation cooling, according to data freshly released by CoreLogic.

Surprisingly, the home price trajectory didn’t waver significantly, with values still ascending for the 136th successive month in May, as affirmed by CoreLogic. A refined perspective shows a 0.9% month-over-month elevation compared to April, showcasing the tenacity of the housing market’s upward drive.

Unpacking the trend, Selma Hepp, CoreLogic’s esteemed chief economist, emphasized the sustained deceleration in annual home price escalation, especially post the zenith witnessed in spring 2022. In the midst of this moderation, Hepp elucidated the continued vigor in monthly price gains, a momentum upheld even in the face of recent increments in mortgage rates.

Nevertheless, as the realm of homebuying witnesses a cumulative escalation of nearly 4% in home prices from February to April of 2023, the landscape is adorned with the challenges posed by elevated mortgage rates and soaring home prices. Selma Hepp succinctly portrays the dynamics at play, shedding light on the manner in which these elements are coalescing to temper the month-over-month home price growth. The trajectory, while in a state of tapering, is seen veering back toward the pre-pandemic average, showcasing a 0.9% surge from April to May.

Nonetheless, CoreLogic casts its gaze into the future, weaving predictions of annual home price gains potentially intensifying to 4.5% by the time May 2024 graces the calendar.

Homebuyers Advised to Navigate Mortgage Options Strategically

A piece of wisdom shines through amidst the intricate fabric of real estate intricacies: to stem the tide of surging home buying prices, the diligent shopper would be wise to cast their net wide in pursuit of the best mortgage rates. The prudent course of action is to visit Credible, where a wealth of options from diverse lenders await comparison, all without casting a shadow on your credit score.

Westward Bound: Annual Home Price Declines in Western States

The panorama of Western states reveals a noteworthy phenomenon: a considerable number of these states witnessed annual home price contractions when measured year-over-year in May, a trend meticulously laid out in the CoreLogic report.

This spatial pattern of declining home values is woven into a narrative shaped by out-migration from less urban realms, a migration that swelled during the zenith of the COVID-19 pandemic. Additionally, affordability struggles are interwoven with the storyline, a consequence stemming from the ripples of recent home price surges.

H2: Striking Disparities in Home Price Changes

The CoreLogic report paints a vivid picture of areas that bore the brunt of substantial home price losses. While certain regions felt the weight of price diminution, the vibrant city of Miami, Florida, emerged as an outlier, showcasing an astonishing 11.8% annual home price surge in May. Trailing behind are Atlanta, Georgia, and Charlotte, North Carolina, both making commendable strides with gains clocking in at 4.4%.

East Meets West: Dissecting Home Price Gains

The tapestry of home price gains bears a regional fingerprint, with northeastern and southeastern metro areas flaunting their larger strides compared to their counterparts. CoreLogic deciphers this as a result of a two-fold dynamic: a gradual return of workers to job hubs in select corners of the country and a simultaneous embrace of affordable havens in other locales.

Homeowner Regrets Amidst Price Growth Slowdown

Amidst the cadence of home price growth easing its tempo, echoes of regret reverberate from homeowners who embarked on their property journey in 2023. Clever Real Estate’s survey resounds with the sentiment of nearly 93% of homebuyers who admit to rueful contemplations regarding the homebuying process, an uptick from the 72% who shared similar sentiments in 2022.

A striking revelation surfaces, with more than half (58%) of respondents opining that their abode’s valuation tipped the scales towards overpricing. A narrative of financial strain unfolds as homeowners find themselves expending over 23% beyond the national average price for homes, which stands at $516,500. In a year-on-year comparison, this reflects a 31% leap from the $500,156 shelled out in 2022.

Clever’s report attributes these inflated prices to a paucity of available homes on the market. The very essence of demand and supply comes into play, keeping the prices buoyant in their trajectory.

The Pursuit of Home Sweet Home

Amidst the ebb and flow of market dynamics, the yearning for the perfect abode endures. Despite the shackles imposed by elevated mortgage rates, the resoluteness of buyers shines through as they continue to vie fiercely for the property that resonates with their vision of a home. The backdrop has indeed seen a moderated competition, yet the statistics don’t fail to astonish: 38% of home buyers in 2023 dared to surpass the asking price, a notable leap from the 31% of their counterparts in 2022.

For those contemplating the transition into homeownership, the journey to find the most advantageous mortgage rates remains an endeavor worthy of pursuit. The compass points towards Credible, where personalized rates await discovery and expert mortgage guidance stands at the ready.

Download our app MadbuMax on the Apple App Store for the latest news and financial tools. Interested in getting your finances in order do not forget to check Dr. Paul Etienne’s best-seller book on personal finance. To access more resources, tools, and services please click here. Also, do not forget to follow Dr. Etienne on IG or Twitter.