In today’s digital age, online banking has become an essential part of managing your finances. With just a few clicks, you can transfer funds, pay bills, and even apply for loans without ever setting foot inside a bank. However, navigating the world of online banking can be overwhelming for some. In this article, we will guide you through the process and provide you with valuable tips to make the most of your online banking experience.

Understanding the Basics

Before diving into the realm of online banking, it’s crucial to understand the basics. Online banking allows you to access your bank accounts and perform various transactions through the internet. To get started, you need a reliable internet connection and a computer or mobile device.

Choosing the Right Bank

The first step in navigating online banking is selecting the right bank. Consider factors such as reputation, customer reviews, fees, and the range of services offered. Look for a bank that prioritizes security and provides user-friendly online banking platforms.

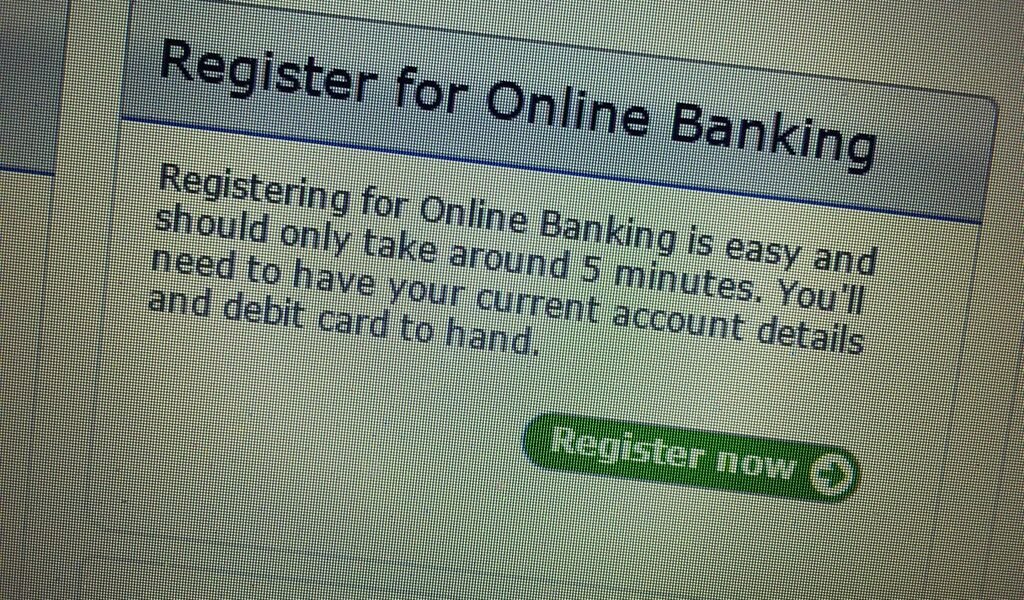

Setting Up Your Account

Once you’ve chosen a bank, the next step is to set up your online banking account. Visit the bank’s website and look for the “Sign-Up” or “Create an Account” option. You will be prompted to provide personal information such as your name, address, social security number, and contact details. Ensure that the website is secure by looking for the padlock symbol in the address bar and “https” in the URL.

Navigating the Online Banking Platform

After setting up your account, familiarize yourself with the online banking platform. Most platforms have a dashboard that displays your account balances, recent transactions, and other relevant information. Explore the different tabs and menus to locate the features you need, such as funds transfer, bill payment, and statement viewing.

Enhancing Security

Security is of utmost importance when it comes to online banking. Protect yourself by following these essential security measures:

- Create a strong and unique password for your online banking account.

- Enable two-factor authentication if available.

- Avoid accessing your account on public Wi-Fi networks.

- Regularly update your computer or mobile device’s operating system and antivirus software.

- Be cautious of phishing attempts and never share your login credentials with anyone.

Conducting Transactions

Online banking offers a wide range of transactional capabilities. Here are some common transactions you can perform:

Funds Transfer

Easily transfer money between your accounts or send funds to other individuals or businesses. Ensure that you enter the correct account details to avoid any errors or delays.

Bill Payment

Pay your bills conveniently through the online banking platform. Add payees and schedule recurring payments to avoid missing due dates.

Loan Applications

Many banks allow you to apply for loans online. Fill out the application form accurately and submit the necessary documents for a smooth loan processing experience.

Staying Updated

Stay informed about the latest features and updates in online banking. Banks often introduce new functionalities to enhance user experience. Check your bank’s website regularly or subscribe to their email newsletters to stay up to date.

Conclusion

Online banking offers convenience and flexibility, allowing you to manage your finances anytime, anywhere. By understanding the basics, choosing the right bank, and following security measures, you can navigate the world of online banking with confidence. Take advantage of the various features and transactions available to simplify your financial management. Start exploring the world of online banking today!

Download our app MadbuMax on the Apple App Store for the latest news and financial tools. Interested in getting your finances in order do not forget to check Dr. Paul Etienne’s best-seller book on personal finance. To access more resources, tools and services please click here. Also do not forget to follow Dr. Etienne on IG or Twitter.