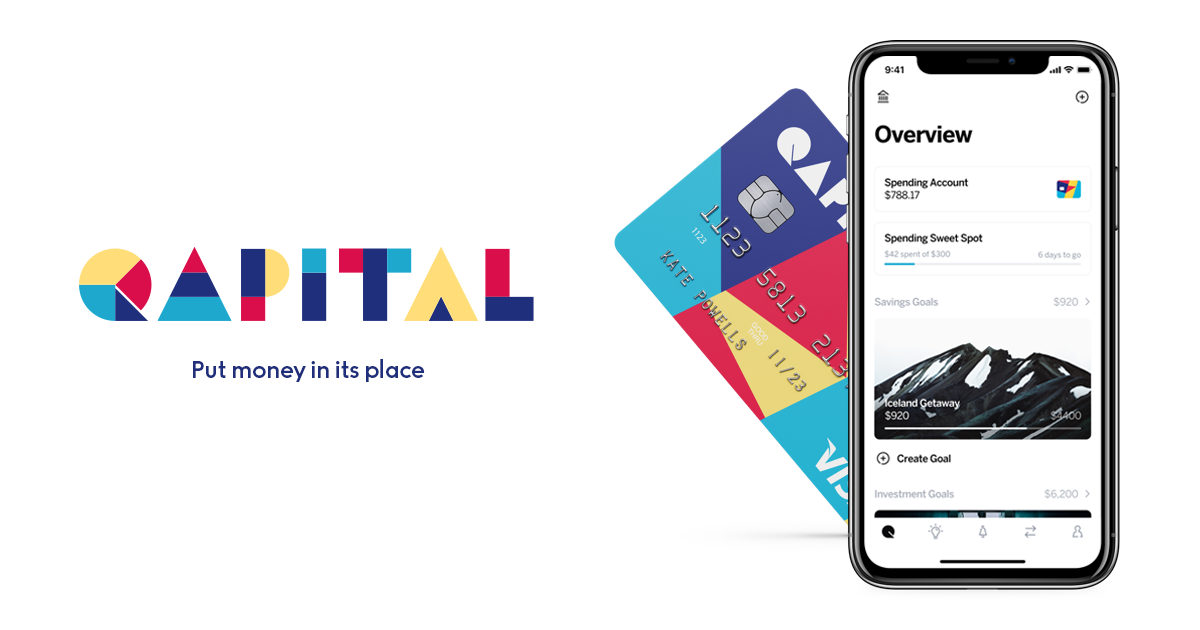

This is a personal finance mobile application app that is supported by both android and IOS operating systems. The app is designed to motivate the users to save their money through the round-ups and other activities across the social media in order to make a major purchase and pay for activities such as vacations. Qapital is just like Acorns, where the money is saved in every transaction, but unlike Acorns lacks the ability for any money to be made via capital gains or dividends. It is a fun way that an individual can save money for their short term goals. This concept was developed in June 2013, and the service was officially launched in May 2015.

This is a very outstanding app, especially for individuals who may have difficulty in saving some money in the past. It has made it possible for one to move their money from a user’s checking account to a separate Qapital account. However, the process of transferring the money follows certain rules which trigger the transfer from the users back account to the Qapital user’s account as agreed with the owners’ account. Therefore, the users are directed to set savings goals, then automatically transfers money from their checking account to the savings account. The transferred money goes to the FDIC-insured account held by Qapital at Wells Fargo Bank.

Moreover, the users have to connect their bank to Qapital, so it knows when one makes a purchase. This connection allows the users to easily monitor various activities among their other financial accounts, such as withdrawals and deposits. Additionally, it opens up a lot of powerful ways on how the users can use their money and make money and also achieve a balance between what they want.

Advantages

No money required to start- for an individual to have an account, there is no requirement of start money. However, for one to start investing, they need to have a minimum of $10. This will allow them to take advantage of Qapital investment services. The users are given the ability to save money by doing what they usually do.

Make saving more effortless and painless– When an individual saves small amounts of money multiple times across the month, they hardly notice when it’s happening. The rules offered make this service very unique in the micro-savings space and makes saving fun to all the users.

Referrals bonus- Qapital offers referral services every time an individual refers to another person to download the app and opens an account using the referral link. The person and the new user will receive $5. This is one of the ways to encourage people to refer others to start using the app.

Disadvantages

No capital gains– While one is using this app, one can’t earn anything. Although they allow the users to save easily for free, one earns nothing from the money saved.

No phone customer service– since the app is customized for online contact; it is difficult for an individual to reach out for customer service through the use of a mobile phone in case they need emergency assistance.

Check out Qapital – I’m using it to save money faster than ever! Sign up using my referral code 822822u8 or this link and we’ll both get $25 >>> Click here to sign up